MTN Nigeria Communications Plc

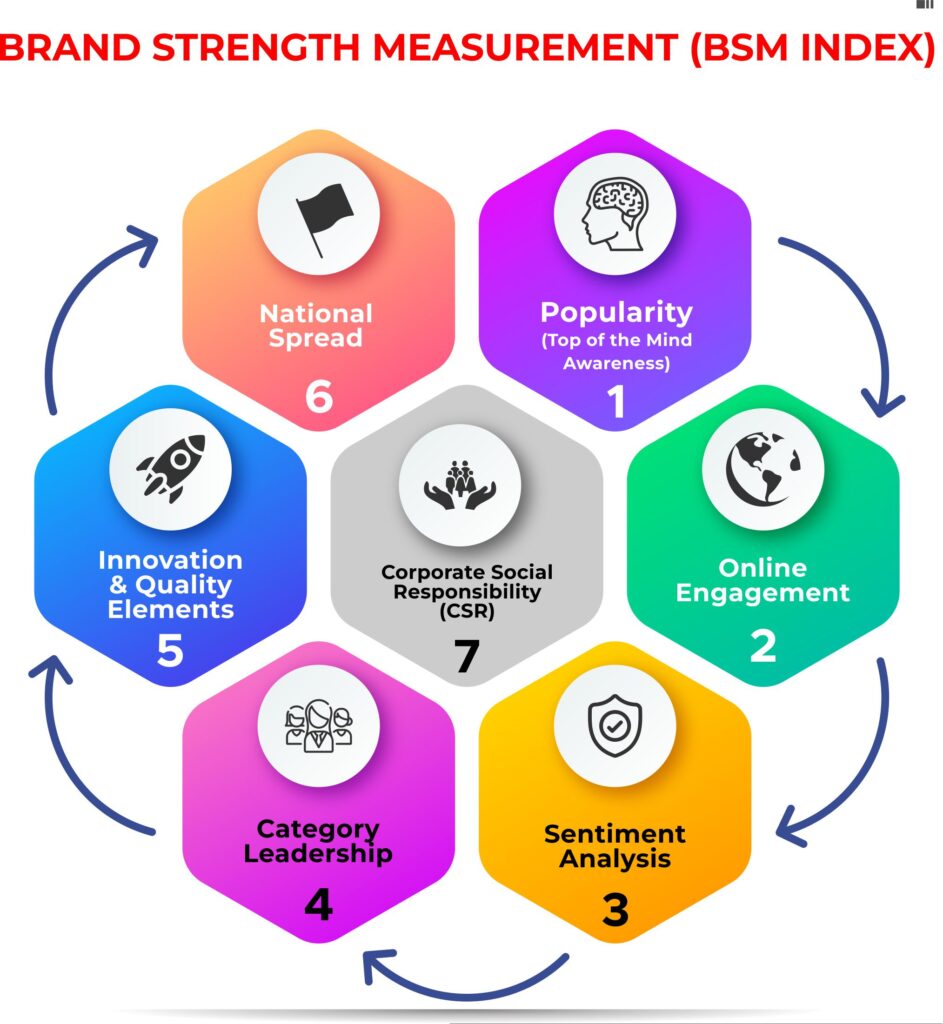

Brand popularity refers to the extent to which a brand is well known, liked and preferred by its target audience. It’s a reflection of the level of public awareness, acceptance and preference for a brand, compare with others. The unveiling of Nigeria’s 50 Most Popular Brands in Nigeria offers more than a list, it paints a living portrait of consumer confidence, national pride, and corporate influence in Africa’s largest economy. The 2025 popularity ranking once again showcase the corporate brands that dominate the public’s imagination, drive everyday choices, and command loyalty across diverse industries.

The 2025 Most Popular Brands is a representation of consumer trust, cultural identity, and corporate ambition. Whether multinational or proudly Nigerian, each brand on the list has earned its place through consistency, relevance, and resonance.

But as competition expectedly intensifies, tomorrow’s leaders must go beyond being popular to being purpose-driven. Nigerian consumers increasingly want brands that not only serve them but also stand with them, in good times and bad times, in national pride and in personal need.

That is the true lesson from this year’s most popular brand ranking. In Nigeria, popularity is power, but trust is everything.

At the very top in this year’s Most Popular Brand is MTN Nigeria, with an extraordinary 84% Top-of-Mind (TOM) mention, that is 84% of respondents listed MTN as one of 10 brands in their mind. This is a reaffirmation of its ‘everywhere you’ mantra, a near-ubiquitous presence across Nigeria.

This is immediately followed closely by Dangote Industries (78%), a proudly Nigerian conglomerate which dominate cement and in most of the industry if its interest, including petroleum. Another proudly Nigerian brand, Globacom (74%), a homegrown telecom giant that continues to champion affordability and cultural identity came third place this year.

Together, these top three set the tone. Popularity in Nigeria is not just about visibility; it’s about trust, consistency, and relevance in a marketplace where consumers are both discerning and deeply emotional about the brands they embrace.

Why Brand Popularity Matters

Popularity is more than just a metric. It is a direct measure of influence and staying power in a market of over 230 million people (World Bank). In Nigeria, like in many other major economy, where competition is fierce and consumer loyalty can be fleeting, being “top of mind” means:

- Trust earned through consistency: A brand repeatedly recalled by consumers without prompts (as measured in the TOM survey) has achieved a depth of familiarity that money alone cannot buy.

- Market advantage: Popular brands often command premium pricing, attract partnerships, and are first in line when consumers have to choose. They became popular for a reason.

- Cultural relevance – In Nigeria, brands are often woven into the daily fabric of life. From a bottle of Coke on a hot afternoon to a Glo-sponsored cultural festival, popularity indicates emotional connection and integration into society.

A McKinsey study on African consumer sentiment emphasizes this, noting that ‘brand trust is a top decision factor for 67% of African consumers, higher than global averages’ (McKinsey, 2022). In other words, a popular brand is not just known, it becomes a natural choice, again and again.

How Brands Achieve Popularity

Drawing on insights from last year’s TOM-based analysis and this year’s results, six consistent factors seem to stand out:

1. Strong Visual Identity

Colors, logos, and design cues are powerful memory anchors. MTN’s “bright yellow” is instantly recognizable across Africa, while Coca-Cola’s special script font remains one of the most iconic in the world. In Nigeria, this visual recall has helped brands stay stuck in consumer memory, especially in a crowded market, such that a flash of these identities evoke instant memories.

2. Meeting Consumer Expectations

Brands that consistently deliver quality and reliability grows, evidently. Dangote cement is synonymous with durability; First Bank, with stability; Julius Berger with quality and durable constructions, and FrieslandCampina’s Peak Milk, with nourishment. Once expectations are met and exceeded, repeat patronage and word-of-mouth naturally follow without struggle.

3. Positive Customer Experience

Positive customer experience has repeatedly shown to be a key factor that drive admiration and invariably affect popularity. The banking sector is a prime example: Access Bank, Zenith and GTCO have climbed the rankings by streamlining digital platforms and investing in customer care. A PwC Nigeria survey found that 73% of consumers point to customer experience as a key factor in loyalty (PwC Nigeria, 2021). Consumers will naturally gravitate toward the people that attend to your needs and enquiries professionally and timely. They are also likely going to tell others. Similarly, they will tell much more others when these brands live below expectations.

4. Emotional Connection

Some of the most loved brands don’t just sell products, they sell feelings. Brands like BUA which always shows connection with the consumer, Globacom’s sponsorship of popular festivals and Nollywood resonates with cultural pride. Toyota Nigeria with it Dream Car Art Contest among children (even though children don’t buy cars), shows emotional connections which touch a chord with everyday Nigerians. Emotion cements memory.

5. Market Presence and Accessibility

As the saying goes, “if your product isn’t everywhere in Nigeria, it’s nowhere.” Brands like Bigi Cola or Fearless (Rite Foods), Bull Rice or Terra (from TGI), Dangote products, and Indomie (Dufil Prima Foods) thrive because they are found almost everywhere, from Lagos to Maiduguri, from kiosks to supermarkets. Their continuous popularity and market share is greatly driven by availability. Ubiquity itself creates trust!

6. Leadership and Strategy

Behind every popular brand is decisive leadership. Aliko Dangote’s aggressive expansion strategy has ensured not just visibility but also dominance. Similarly, MTN’s early investment in telecom infrastructure gave it a lead that others still struggle to catch.

The 2025 Rankings Insights and Industry Patterns

The 2025 list mirrors some continuities from 2024 but also highlights shifts in consumer preferences.

- Telecoms still rule: MTN, Glo, and Airtel all hold top 10 spots. With over 220 million active mobile subscriptions (NCC, 2024), telecoms remain lifelines in Nigeria’s digital economy.

- Banks dominate: With 11 Banking and financial services brands making the cut. This sector is clearly Nigeria’s most competitive branding battleground. First Bank (62%) and Zenith (60%) continue to symbolize trust, while newer players like Moniepoint, Opay and Flutterwave represent the fintech disruption effects and are fast becoming the goto bankers of the masses.

- Conglomerates and consumer goods remain strong: Dangote (78%) and BUA Group (44%) highlight Nigeria’s industrial powerhouses, while consumer goods companies like FrieslandCampina and Unilever maintain relevance through household staples.

- Media still matters: The media weren’t left behind, with Channels TV (24%) leading the pack, followed by Punch (18%), and ThisDay (18%). This again prove that despite the rise of social media, legacy media brands still command some levels of trust in Nigeria.

On the overall this year, there are 26 multinationals versus 24 Nigerian brands on the list of the most popular brands. This almost balance outcome in a way shows that, while global brands are strong, homegrown Nigerian companies are not just surviving, they are thriving and shaping consumer identity.

Benefits of Brand Popularity

Being popular in Nigeria confers a number of tangible and intangible benefits:

- Market Leadership – MTN’s position for example means it can in some ways dictate industry standards and pricing models. While there are regulators, it can still influence a lot of things with its cheer popularity among subscribers. Same goes for other industries.

- Customer Loyalty – Repeat patronage translates into long-term profitability; for instance, Dangote cement retains dominance despite competition. By its level of acceptability, which has resulted to popularity. Some customers had even become completely loyal to the brand to the point that it is ‘Dangote or Nothing’ for them.

- Investor Confidence – Popular brands attract investors. For a brand to be a talk-of-the-town (popular), it means they are doing certain things right and are growing. Investors will naturally gravitate towards thriving brands.

- Policy Influence – Recognized brands often wield more influence in shaping regulatory discussions. That’s true! They are well informed and always carried along before policies are formulated. Often time, they influence these policies by virtue of the status as the people’s brand.

- Cultural Permanence – To many consumers, these brands aren’t just offering products and services, they are cultural symbol, sometimes, influencing the popular culture. That permanence is priceless.

The Popularity Divide: Nigerian versus. Multinational Brands

One of the most fascinating aspects of the ranking is the balance between multinational giants and Nigerian champions.

- Multinationals like Coca-Cola, Axa Mansard, Stanbic IBTC and Nestlé benefit from global scale, marketing muscle, and legacy reputation.

- Nigerian brands like Dangote, First Bank, Julius Berger, Rite Foods, Channels TV, and Air Peace thrive on local insight, cultural relevance, and national pride.

This duality suggests that Nigerian consumers are not blindly drawn to foreign brands. Instead, they reward relevance and trust, regardless of origin. Moreso, the reward wasn’t just a blind patriotism, but a result of true value.

Popularity as a Business Strategy

We may want to view popularity as organic, but the truth is, popularity is engineered through deliberate strategy by these brands. Some of the deliberate strategies employed by these popular are advertisement and valuable sponsorship.

- Advertising spend, for example, plays a big role in becoming popular. A 2024 statista report indicated that Nigerian businesses spent over ₦605 billion on advertising in 2023

- Sponsorships are another lever. Brands like Globacom’s alignment with sports and MTN’s music partnerships, same goes for Pepsi. These show how culture and commerce intersect.

As brands plan for the future, understanding how to convert awareness into affection and affection to loyalty will define who makes the top and rule the market, and those who fades away.

The Future of Brand Popularity in Nigeria

For this popularity drive and the endless race to the throne, certain factors will determine those that will keep winning. Some of these are:

- Digital Transformation – Nigeria with its over 122 million internet users (NCC, 2024), highest in Africa, provides a veritable platform to become popular. Digital-native brands like Opay, Moniepoint, and Flutterwave will rise further.

- Sustainability & CSR – Consumers are increasingly attentive to brands that “do good.” Dangote’s food security investments, Coca-Cola’s recycling programs, BUA with its continuous support programmes and price sensitivity these times will further solidify their positions.

- Youth-driven Trends – Since Nigeria is a youthful economy, with over 60% of the population under 25 (UN, 2023), youth culture and youth driven initiatives will dictate the next wave of popular brands, especially in fintech, portable electronics and entertainment, and consumer goods.