When people think of global business hubs, Silicon Valley, Dubai, Singapore, or Shanghai are usually the destinations that come to mind. Nigeria rarely does. Yet, Africa’s most populous nation is quietly becoming one of the most consequential frontier markets in the world for business opportunities for the next decade and beyond.

With over 230 million people and growing, a rapidly diversifying economy, right government policies and reforms, deep digital adoption, and expanding regional trade access, Nigeria today represents scale, momentum, and optionality that few emerging markets can match.

Nigeria at a Glance (2025)

| Indicator | Nigeria | Kenya | Ghana | South Africa |

| Population | 234 million | 56m | 34m | 64m |

| Median Age | 18.1 years | 20.0 years | 21.3 years | 28 years |

| Nominal GDP (2025) | 285 billion | $120bn | ~ $88-$112 bn | ~ $410-$426 bn |

| GDP Growth (2025) | 4.0% | 4.8% | 4.0 | 1.1% |

| Non-Oil GDP Share | >95% | Higher diversification | ||

| Internet Users | 140m | 27.8m | 24.3m | 50.8m |

Nigeria at a glance

Reason #1: Africa’s Largest, Youngest Consumer Market

Nigeria is Africa’s largest market by population and one of the youngest in the world. This single fact alone explains why discerning global companies, investors, and entrepreneurs continue to pay close attention to the country despite its challenges, most of which are now getting the right attention from the present government.

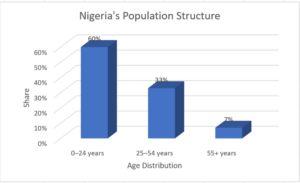

At the end of 2025, Nigeria’s population is estimated at approximately 234 million people, making it larger than the populations of Kenya, Ghana and south Africa combined by a wide margin. Even more important than size is the structure of the population. Over 60% Nigerians are under the age of 25, and the country’s median age is just 18.1 years, compared to 20 years in Kenya, 21.3 years in Ghana, and 28 years in South Africa and way higher in most major world economies.

A youthful population translates into longer consumption cycles, faster adoption of new technologies, and sustained demand for goods and services over decades rather than years. It also means a continuously expanding workforce and entrepreneurial base.

According to United Nations projections, Nigeria’s population on track to become the third most populous country in the world by 2050, after India and China. For serious businesses, this is about building in a market that will continue to grow for several decades.

Nigeria Population Structure

Reason #2: Strong Growth Driven by Non-Oil Sectors

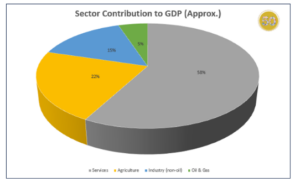

Nigeria’s recent economic performance shows that growth is being powered by other non-oil sectors, largely. This highlights the country’s diversifying growth engine.

According to the National Bureau of Statistics (NBS), Nigeria’s real Gross Domestic Product increased by approximately 3.98% year-on-year in the third quarter of 2025, from 3.86% in the previous year. This expansion was primarily driven by strong activity in services, agriculture, industry, and other non-oil sectors, even as the oil sector’s share of total GDP remained relatively small at just over 3% of output. As reported variously –

- The non-oil economy grew by about 3.9% in Q3 2025, outperforming overall GDP growth, a strong indication continued diversification. Nairametrics

- The services sector accounts for over 53% of total output, with strong performances in telecommunications, real estate, trade, transport, and financial services. Legit.ng – Nigeria news.

- Agriculture continued to expand, growing close to 3.8% year-on-year, led by crop production, which is a core engine of rural and non-oil growth. Nairametrics

- Other contributors to the non-oil expansion included industry (e.g., construction and manufacturing), financial institutions, and commerce sectors etc. Nairametrics

Sectoral Contribution to GDP

Reason #3: A Rising Middle Class and Expanding Consumer Spending

Nigeria’s consumer economy is one of the fastest-scaling in Africa. This is supported by population growth, urbanization, and rising digital adoption.

Reports indicates that approximately 23% of Nigerians are now within the middle class, arguably, tens of millions of consumers with increasing purchasing power. Total consumer spending in 2025 is estimated at around $120–$122 billion, with forecasts estimation at an annual growth of about 6%.

While per capita disposable income still remains modest, that’s is around $600 per year, the sheer size of the population strengthened aggregate demand. Food and beverages remain the largest spending category, expectedly, however, discretionary spending on telecommunications, financial services, entertainment, transportation, and e-commerce has continues to rise.

Good digital adoption is a kay factor that is enhancing this acceleration. With 140 million internet users, Nigerian consumers are increasingly comfortable with shopping online, mobile payments, digital banking, and other subscription-based services. This has increased market accessibility and significantly lowered barriers to entry, enabling startups and established firms alike to scale faster than would be possible through traditional brick and walls alone.

Nigeria Middle Class

Reason #4: A Strategic Gateway to West and Central Africa

Nigeria’s large domestic market in West Africa is also the anchor economy for West Africa and one of the most strategically positioned countries on the continent.

As the largest economy within the Economic Community of West African States (ECOWAS), Nigeria accounts for around 50% of the region’s population and approximately 65% of its GDP. This gives businesses operating in Nigeria privileged access to a regional market of over 400 million consumers.

Beyond ECOWAS, Nigeria is also a key beneficiary of the African Continental Free Trade Area (AfCFTA), which creates access to a single market of 1.3 billion people with a combined GDP of approximately $3.4 trillion. As trade barriers gradually reduce, Nigeria is positioned to serve as a manufacturing, logistics, and services hub for the continent.

This strategic advantage is being supported by major infrastructure investments in the country, such as the The Lekki Deep Sea Port, with a capacity of 2.5 million TEUs, one of the largest and most modern ports in Africa.

For companies with regional ambitions, targeting a 400 million regional market, Nigeria is more than a destination market, it is a launchpad into the region and beyond.

Reason #5: Agriculture and Natural Resource Upside

The Nigeria agriculture sector which combines scale, abundant arable land, labor availability, and export potential is about its most underleveraged and underdeveloped opportunity, The country has an estimated 70 million hectares of arable land, with a significant portion still underutilized. Essentially, agriculture contributes approximately 20–23% of GDP and employs about 35% of the workforce, making it both an economic and social strength.

In 2024 alone for example, Nigeria recorded an estimated 250% year-on-year increase in agricultural exports over the previous year, as a result of rising global demand and improved export logistics. The country is already a leading exporter of cocoa, cashew, sesame, and ginger, with growing interest in value-added processing rather than raw exports.

Beside agriculture, Nigeria is endowed with over 40 commercially viable mineral resources, including limestone, gold, lithium, iron ore, bitumen and lots more. These are still largely untapped as mining presently contributes less than 1% of GDP, signalling massive upside potential.

Reason #6: Africa’s Leading Tech and Digital Economy

According to reports, Nigeria is widely recognized as the largest and most dynamic tech ecosystem in Africa. The country leads the continent in startup formation, venture capital raised, and unicorn creation. Its digital economy is driven by a combination of population scale, widespread mobile usage, and an entrepreneurial culture that thrives among the people.

The ICT sector has become a growing contributor to the GDP with approximately 19% annual contribution, and projected to reach 25% by 2030. Nigeria presently has over 140 million internet users, the largest digital population in Africa, and accounts for an estimated 28% of Africa’s fintech market.

Nigeria is also home to some of Africa’s most prominent tech unicorns, including Flutterwave, Paystack, Interswitch, and Opay. These companies have shown that it is possible to build globally competitive platforms from Nigeria that could serve both domestic and international markets.

Digital payments, fintech, e-commerce, logistics technology, and software-as-a-service (SaaS) are scaling faster in Nigeria than in most other African markets, making the country the continent’s primary testing ground for digital innovation.

Nigeria Digital Economy

Reason #7: A Global Cultural and Creative Centre

Nigeria is a culturally diverse country, with influence that extends beyond just the African continent. And this global influence is increasingly getting monetized.

The Nigerian movie industry, Nollywood for example, is the second largest in the world by volume, producing thousands of films annually and supporting a vast ecosystem of writers, producers, actors, and distributors. The creative sector contributes an estimated 2 – 3% of GDP and supports over one million jobs.

Nigerian music exports have enhanced its global presence and culture even further. For example, Nigerian Afrobeats artists have consistently top international charts, sell out global arenas, and collaborate with major global brands etc.

For businesses, Nigeria’s creative offers opportunities in media, advertising, streaming, fashion, tourism, and intellectual property monetization. Culture is now beyond just soft power, it is a revenue-generating asset.

Reason #8: Diaspora Capital and Global Networks

An estimated 20 million Nigerians live abroad, making up of world class professionals, financial, and entrepreneurial networks across North America, Europe, and Asia. This has become a great source of foreign income into housing, small and medium-sized enterprises, education, healthcare, and increasingly, startups and venture investments.

In 2024, remittances to Nigeria summed up to $21 billion, $23billion in 2025, accounting for about 37% of total remittance flows to Sub-Saharan Africa. This is expected to keep growing into the next decade. These inflows are more than four times larger than foreign direct investment (FDI), making diaspora capital one of Nigeria’s most stable sources of foreign exchange.

Diaspora Capital Flow

Reason #9: Financial Markets and Stock Exchange Growth

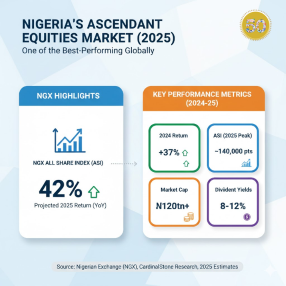

Nigeria’s financial markets is now one of the strongest performers among frontier and emerging economies, reflecting renewed investor confidence and structural reforms of the present government.

Between 2024 and 2025, the Nigerian Exchange (NGX) delivered returns of over 35%, making it one of the best-performing stock markets globally during that period. Market capitalization has expanded beyond ₦120 trillion, supported by strong earnings from banking, telecoms, consumer goods, and energy companies.

Key reforms including foreign exchange market liberalization, tighter monetary policy, and improved capital repatriation mechanisms have all helped to restore liquidity and attract both domestic and foreign investors. Dividend yields in some sectors now range between 8 -12%, offering attractive income alongside capital appreciation, one of the economies where such can be achieved in the world.

Nigeria Equity Market

Reason #10: E-Commerce and Retail Explosion

Nigeria’s retail and e-commerce sectors, both small and large are experiencing rapid expansion that is driven by increasing digital adoption, mobile payments, and changing consumer behaviour.

By 2025, Nigeria’s e-commerce market is estimated at $9 -10 billion, with projections suggesting growth to almost double, $16-18 billion by 2030. More than 70% of transactions now occur via mobile devices, reflecting the country’s growing mobile-first consumer base.

With over 140 million internet users, (more than double the population of England), Nigeria offers very good scale for online retail in Africa. Beyond traditional platforms, social commerce, logistics technology, and fintech-enabled marketplaces are reshaping how goods move from producers to consumers.

Nigeria E-commerce and Retail Growth

Reason #11: Pro-Business Reforms and Investment Incentives

Nigeria has made meaningful progress in improving its business and investment climate through policy reforms and regulatory modernization. The past couple of years in particularl have seeing such initiatives as.

- Introduction of a Regulatory Impact Analysis framework

- Digitization of tax administration through the Nigeria Revenue Service

- Establishment of over 44 Free Trade Zones nationwide

- Attraction of more than $26 billion in new investments

- Guaranteed full profit repatriation for qualifying foreign investors

While there are still challenges, the policy direction is increasingly market-oriented and investor-friendly, signalling long-term commitment to private-sector-led growth.

Reason #12: Urbanization and the Real Estate Boom

Nigeria is urbanizing quite fast, one of the fastest rates in Africa, creating sustained demand for housing, infrastructure, and commercial real estate.

Presently, there is an estimated housing deficit of over 22 million units, with the total real estate market valued at more than $56 billion. Lagos, Africa’s fastest-growing megacity, continues to attract domestic migration, foreign capital, and multinational businesses.

Compared with markets such as Kenya, Ghana, and South Africa, Nigeria combines larger urban scale with faster growth, making real estate development a long-term opportunity rather than a cyclical one.